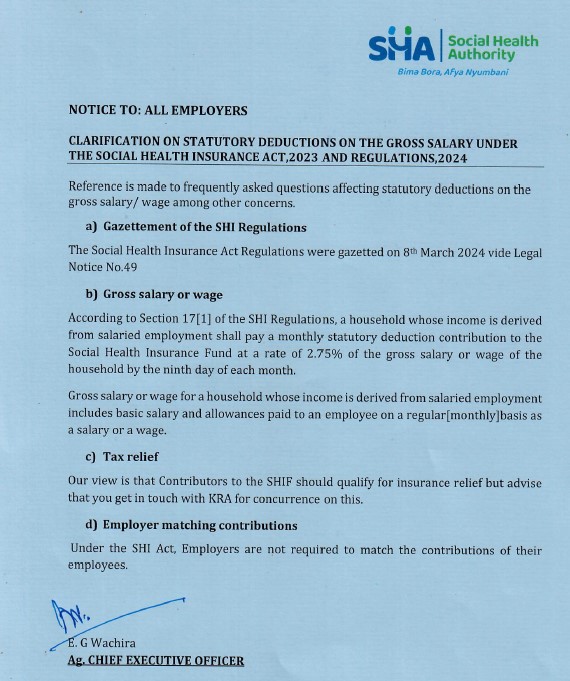

The Social Health Authority (SHA) has issued a notice to employers providing clarification on SHIF contributions. Gross salary or wage, for SHIF purposes, includes basic salary and allowances paid regularly (monthly). One-off payments like bonuses are not subject to SHIF deductions. While the SHA believes SHIF contributions should qualify for insurance relief under the Income Tax Act, employers are advised to consult KRA for confirmation.

Importantly, employers are not required to match employee SHIF contributions. For households with salaried income, the statutory deduction is 2.75% of the gross salary or wage, which employers must remit by the 9th of each month. Some employers have faced confusion regarding remittance. All deductions should be based on individual gross monthly income, not a uniform amount per employee. SHIF contributors may qualify for tax relief, but clarification should be sought from KRA.

The SHA CEO, Elijah Wachira, emphasized the importance of adhering to these guidelines and cautioned against unnecessary delays or incorrect deductions. The government aims to address initial challenges in the SHA rollout and ensure a smooth transition to the new health insurance scheme.

Implementing these changes seamlessly is essential. FaidiHR’s payroll system is a comprehensive solution that’s already equipped to handle monthly statutory deductions for SHIF. Streamline your payroll processes effortlessly with FaidiHR, ensuring compliance and efficiency every step of the way.