In today’s fast-paced and increasingly digital world, businesses in Kenya are shifting from traditional payroll methods to digital payroll systems. This transformation is more than just a trend—it’s a strategic move driven by the need for efficiency, accuracy, and compliance in managing employee compensation. As Kenya’s economy grows and integrates more deeply into the global market, adopting a digital payroll system, such as FaidiHR, has never been more essential. In this post, we’ll explore the key benefits of digital payroll systems and why FaidiHR is the solution Kenyan businesses of all sizes need.

Enhanced Accuracy and Reduced Errors

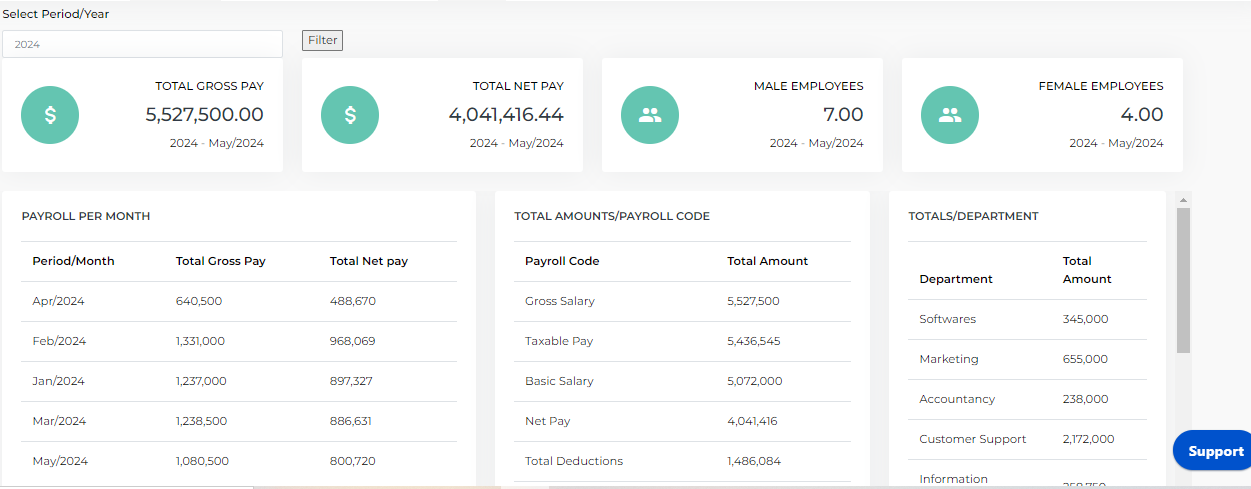

Let’s face it—manual payroll processes are prone to mistakes. Whether it's miscalculating salaries, overlooking tax deductions, or entering the wrong numbers, these errors can have serious consequences. FaidiHR drastically reduces the likelihood of such mistakes by automating payroll calculations. From basic salary computations to tax deductions, FaidiHR ensures everything is done accurately and consistently. This automation not only minimizes human error but also saves businesses both time and money.

For example, payroll errors that lead to underpayment or overpayment can hurt employee morale and cause legal complications. With FaidiHR, businesses can guarantee that employees are paid accurately and on time, fostering trust and satisfaction among staff.

Time-Saving and Increased Efficiency

Processing payroll manually is not only error-prone—it’s time-consuming, especially with a large workforce. FaidiHRsimplifies the entire process by automating tasks such as calculating wages, deductions, and taxes, while also generating payslips instantly. This efficiency allows HR and finance teams to shift their focus to more strategic initiatives, such as employee development and workforce planning.

In addition, FaidiHR integrates seamlessly with other HR and accounting tools. For instance, when paired with time and attendance software, it can automatically record employee hours, streamlining operations even further. This ensures payroll data is consistent across all platforms and accessible in one place.

Improved Compliance with Kenyan Labor Laws

Navigating Kenya’s labor laws can be complex, especially as they continue to evolve. FaidiHR ensures businesses remain compliant by staying up-to-date with changes in tax rates and labor regulations. The system automatically applies the latest updates, reducing the risk of penalties for non-compliance.

For example, with the Kenya Revenue Authority (KRA) frequently adjusting tax bands and regulations, FaidiHR guarantees accurate tax deductions and submissions every time. This also simplifies year-end tax filings, saving businesses time and stress.

Data Security and Confidentiality

Payroll data is sensitive, containing personal employee information such as bank details, salary figures, and tax data. Protecting this information is crucial for compliance and maintaining employee trust. With FaidiHR, businesses benefit from robust security features like encryption, secure access controls, and regular data backups.

In Kenya, where cyber threats are becoming more prevalent, using FaidiHR ensures that payroll data remains secure. The system offers a secure environment for storing and processing sensitive information, protecting it from unauthorized access.

Cost-Effectiveness

While the initial investment in digital payroll might seem daunting, FaidiHR offers long-term savings. By reducing the risk of costly errors, minimizing time spent on payroll, and eliminating the need for physical storage, FaidiHR proves to be an economically sound solution.

For small businesses in Kenya, where every shilling counts, the cost savings with FaidiHR can be substantial. Automating payroll processes reduces the need for large HR teams, allowing businesses to allocate resources more effectively.

Accessibility and Remote Work Support

The COVID-19 pandemic has shown the importance of flexible, remote work capabilities. With FaidiHR's cloud-based platform, businesses can manage payroll from anywhere, at any time. This accessibility is ideal for businesses with multiple locations or remote employees, offering full control of payroll processes regardless of where HR teams or managers are located.

In Kenya, where remote work is gaining popularity in industries like IT and digital marketing, FaidiHR’s cloud capabilities offer a significant advantage.

Employee Self-Service

With FaidiHR, employees have access to self-service portals where they can download payslips, request leave, and update their personal information—all without needing to contact HR. This empowers employees and reduces the administrative burden on HR teams.

Given Kenya’s high mobile penetration, FaidiHR offers mobile access for employees, allowing them to check payroll information on the go. This convenience boosts employee satisfaction and reduces payroll-related inquiries.

Scalability

As your business grows, your payroll needs evolve. FaidiHR is designed to scale with you, accommodating more employees, multiple locations, and complex payroll requirements. Whether you’re a small startup or an expanding enterprise, FaidiHR grows with your business.

For example, a Nairobi-based business that expands nationwide can rely on FaidiHR to manage payroll effortlessly, regardless of size.

Environmental Sustainability

By going digital, businesses reduce their need for paper-based payroll processes, contributing to environmental sustainability. FaidiHR supports businesses in minimizing their carbon footprint by eliminating paper payslips and tax forms, helping Kenyan businesses lead the way in eco-friendly operations.

Conclusion

FaidiHR offers a wide range of benefits for Kenyan businesses, from enhanced accuracy and efficiency to improved compliance and security. In a rapidly changing business landscape, using a solution like FaidiHR is essential for staying competitive, reducing costs, and supporting business growth.